The emergence of shale gas as a significant energy source has had a transformative impact on the petrochemical industry. By providing an abundant and cost-effective feedstock, shale gas has reshaped production dynamics, global trade, and market competitiveness. Here’s an in-depth analysis of its effects:

1. Abundant and Low-Cost Feedstock Supply

- Ethane Availability:

- Shale gas is rich in natural gas liquids (NGLs) like ethane, which serve as a critical feedstock for ethylene production.

- Impact:

- Lower production costs for ethylene and downstream products such as polyethylene, PVC, and polystyrene.

- Example:

- The U.S. has experienced a surge in ethylene production, driven by low-cost ethane from shale gas.

2. Competitive Advantage for the U.S.

- Manufacturing Renaissance:

- The U.S. petrochemical industry has gained a significant cost advantage over regions relying on naphtha as a feedstock.

- Export Growth:

- Increased exports of ethylene, polyethylene, and propane from the U.S. to global markets.

- Investment Surge:

- Billions of dollars invested in new ethane crackers and petrochemical facilities, particularly in the U.S. Gulf Coast.

3. Shift in Global Trade Dynamics

- Rise of the U.S. as a Major Exporter:

- The U.S. has become a key supplier of ethane, LPG, and petrochemical products, altering traditional trade flows.

- Regional Competitiveness:

- Middle East producers, historically dominant due to cheap oil-based feedstocks, face competition from shale gas-based producers.

- Impact on Asia:

- Asia, as a major consumer, benefits from lower-cost imports but faces challenges in adapting to ethane-based production processes.

4. Feedstock Flexibility

- Shift from Naphtha to Ethane:

- Petrochemical plants in shale-rich regions optimize for ethane cracking, reducing dependence on naphtha.

- Impact:

- Lower production costs for ethylene-based products.

- Reduced production of co-products like propylene and butadiene, leading to supply tightness and price volatility for these chemicals.

5. Impact on Investment and Capacity Expansion

- Ethane Cracker Projects:

- Numerous ethane crackers have been built in the U.S., significantly increasing global ethylene capacity.

- Integrated Complexes:

- Investments in integrated petrochemical complexes to maximize efficiency and cost savings.

- Global Replication:

- Other regions, like China and India, are exploring shale gas potential to replicate the U.S. model.

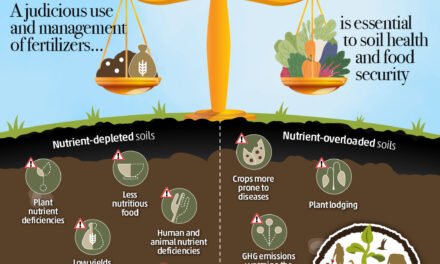

6. Environmental and Sustainability Considerations

- Carbon Emissions:

- While shale gas is cleaner than coal, its extraction and use still contribute to greenhouse gas emissions.

- Methane Leakage:

- Methane leaks during shale gas extraction and transport present a significant environmental concern.

- Circular Economy Push:

- The petrochemical industry is investing in recycling and bio-based alternatives to address sustainability concerns while leveraging shale gas for transitional growth.

7. Technological Advancements

- Cracking Technology:

- Development of ethane-specific cracking technologies to optimize yields and reduce energy consumption.

- Efficiency Improvements:

- Advanced catalysts and process integration reduce energy use and operational costs in shale-based petrochemical production.

8. Impact on Downstream Industries

- Plastics:

- Surge in low-cost polyethylene and polypropylene production has driven growth in the packaging and automotive sectors.

- Specialty Chemicals:

- Availability of cheap ethylene has encouraged investment in downstream specialty chemicals like ethylene oxide and ethylene glycol.

9. Geopolitical and Economic Implications

- Energy Independence:

- Shale gas has reduced U.S. reliance on imported oil and gas, reshaping global energy geopolitics.

- Economic Growth:

- Increased employment and economic activity in regions with significant shale gas reserves.

- Price Volatility:

- Fluctuations in shale gas production and pricing can impact petrochemical feedstock costs and market stability.

10. Challenges and Risks

- Infrastructure Needs:

- Significant investment in pipelines, storage, and export facilities is required to fully utilize shale gas resources.

- Market Saturation:

- Overcapacity in ethylene and polyethylene markets may lead to price pressure and reduced profitability.

- Environmental Opposition:

- Public and regulatory pushback against hydraulic fracturing (fracking) may limit shale gas expansion in certain regions.

11. Case Studies

- Shell Pennsylvania Petrochemical Complex:

- A $6 billion investment in a shale gas-based ethane cracker to produce polyethylene in the U.S. Northeast.

- China’s Shale Gas Initiative:

- Efforts to replicate U.S. success with shale gas to support its growing petrochemical demand, albeit with limited progress due to geological and regulatory challenges.

12. Future Outlook

- Sustainability Shift:

- As the world transitions to renewable energy, shale gas may serve as a bridge fuel while the petrochemical industry pivots to bio-based and recycled feedstocks.

- Technological Innovations:

- Advances in carbon capture, utilization, and storage (CCUS) and methane leak prevention will address environmental concerns.

- Global Expansion:

- Regions with untapped shale gas reserves, such as Argentina and South Africa, may drive the next wave of shale-driven petrochemical growth.

Conclusion

Shale gas has revolutionized the petrochemical industry by providing a cost-effective and abundant feedstock, driving growth and reshaping global markets. While it offers significant economic and competitive advantages, challenges related to environmental sustainability, infrastructure, and market dynamics must be addressed to ensure long-term viability. The industry’s ability to innovate and adapt will determine how effectively it navigates the evolving energy and petrochemical landscape.

Hashtags

#ShaleGas #ShaleRevolution #NaturalGasImpact #EnergyTransformation #ShaleInPetrochemicals #PetrochemicalIndustryImpact #PetrochemicalGrowth #ShaleGasEconomy #PetrochemicalBoom #NaturalGasInIndustry #PetrochemicalMarketTrends #CostEffectiveEnergy #EnergySupplyChain #ShaleGasEconomics #PetrochemicalSupplyChain #EnergyMarketImpact #SustainableEnergy #ShaleGasDebate #EcoEnergySolutions #GreenPetrochemicals #EnergySustainability #TechInPetrochemicals #EnergyInnovation #ShaleTechnology #FutureOfEnergy #PetrochemicalAdvancements