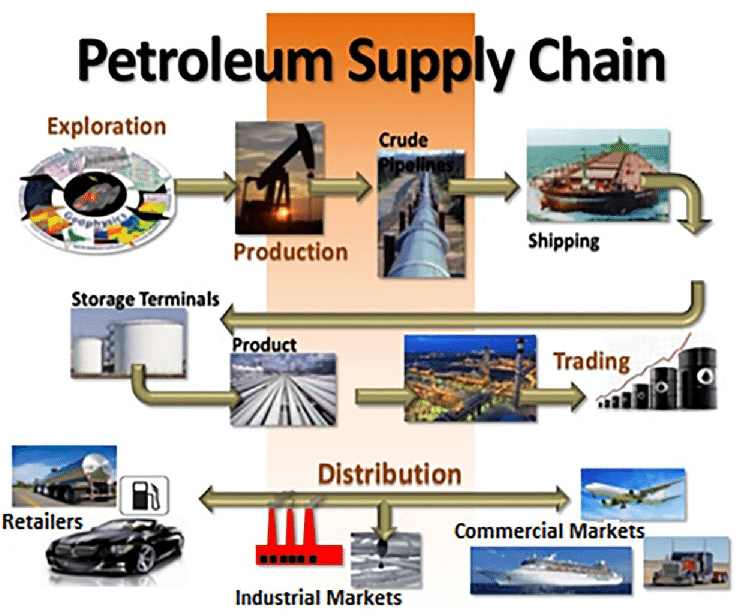

Petrochemical supply chain disruptions can have significant consequences for industries, economies, and consumers. These risks stem from the complexity of the supply chain, dependence on global trade, and the interconnectedness of petrochemical production with various industries. Here’s an analysis of the primary risks associated with petrochemical supply chain disruptions:

1. Feedstock Supply Risks

- Dependence on Crude Oil and Natural Gas:

- Petrochemical production relies heavily on crude oil and natural gas feedstocks. Any disruption in the supply or price volatility impacts the entire value chain.

- Risk Factors:

- Geopolitical tensions in oil-producing regions.

- OPEC production cuts or supply chain bottlenecks.

- Impact of Shale Gas Supply:

- In regions like the U.S., disruptions in shale gas production (e.g., due to regulatory changes or weather events) can reduce the availability of ethane, a key feedstock.

2. Geopolitical and Trade Risks

- Geopolitical Tensions:

- Conflicts, trade wars, or sanctions targeting oil and gas-producing countries can disrupt feedstock supplies and affect downstream petrochemical production.

- Example: Sanctions on Russia have disrupted the global supply of petrochemicals and fertilizers.

- Export Restrictions:

- Governments may impose export restrictions on raw materials or finished products during crises.

- Maritime and Port Risks:

- A significant portion of petrochemical trade relies on maritime transport. Risks include piracy, port strikes, and shipping lane blockages.

- Example: The Suez Canal blockage in 2021 caused delays in global petrochemical shipments.

3. Natural Disasters and Extreme Weather

- Hurricanes and Floods:

- Natural disasters can shut down critical petrochemical hubs, especially in regions like the U.S. Gulf Coast.

- Example: Hurricane Harvey in 2017 led to the shutdown of numerous refineries and petrochemical plants, disrupting global supply chains.

- Droughts:

- Water shortages impact cooling and processing systems in petrochemical facilities.

- Impact of Climate Change:

- Increased frequency of extreme weather events adds long-term uncertainty to supply chain stability.

4. Infrastructure and Logistics Risks

- Aging Infrastructure:

- Outdated pipelines, storage facilities, and transport networks can lead to accidents or inefficiencies.

- Pipeline Disruptions:

- Pipeline failures or sabotage can restrict feedstock flow to petrochemical plants.

- Example: Attacks on oil pipelines in the Middle East have periodically disrupted regional petrochemical production.

- Transport Bottlenecks:

- Shortages of trucking, rail, or shipping capacity delay the movement of raw materials and finished products.

5. Market and Economic Risks

- Price Volatility:

- Sudden spikes or drops in crude oil and natural gas prices can disrupt production planning and profitability.

- Demand Fluctuations:

- Economic recessions or rapid changes in consumer behavior can lead to overproduction or underproduction.

- Example: The COVID-19 pandemic caused a sharp decline in demand for certain petrochemical products, followed by rapid surges.

6. Supply Chain Complexity

- Global Interdependence:

- The petrochemical supply chain is highly globalized, with raw materials, intermediates, and finished products often crossing multiple borders.

- Risk Factors:

- Disruptions in one region can cascade globally, affecting manufacturers and end-users.

- Just-in-Time Practices:

- Lean inventory practices reduce costs but leave little buffer against disruptions.

7. Regulatory and Policy Risks

- Environmental Regulations:

- Stricter emissions and waste disposal regulations can increase operational costs and cause delays in production or transportation.

- Trade Policies:

- Tariffs and trade barriers affect the flow of petrochemical goods.

- Example: The U.S.-China trade war impacted global petrochemical exports and imports.

8. Workforce and Operational Risks

- Labor Shortages:

- Strikes, labor disputes, or workforce shortages can halt operations at critical facilities.

- Example: Strikes in European petrochemical hubs have disrupted production and exports.

- Skill Gaps:

- The industry’s reliance on skilled labor for plant operations makes it vulnerable to workforce shortages.

9. Technological and Cybersecurity Risks

- Cyberattacks:

- Cyberattacks targeting petrochemical companies can disrupt operations, compromise data, or halt supply chains.

- Example: The Colonial Pipeline cyberattack in 2021 disrupted fuel and petrochemical supplies across the U.S. East Coast.

- Technology Failures:

- Breakdowns in automated systems or outdated IT infrastructure can lead to operational inefficiencies.

10. Environmental and Sustainability Challenges

- Push for Decarbonization:

- The shift toward renewable feedstocks and reducing carbon emissions introduces uncertainties in feedstock availability and production processes.

- Circular Economy Initiatives:

- Adopting chemical recycling and bio-based alternatives requires significant supply chain reconfiguration, potentially leading to disruptions during the transition.

11. Downstream Industry Dependence

- Impact on Key Industries:

- Automotive, construction, packaging, and healthcare sectors rely heavily on petrochemicals. Disruptions in supply affect these industries, creating ripple effects across economies.

- Example: A shortage of polyethylene or polypropylene can disrupt packaging and medical supplies.

12. Financial and Investment Risks

- Project Delays:

- Disruptions in funding or supply chain issues can delay the completion of new petrochemical plants.

- Credit Risks:

- Financial instability among suppliers or logistics partners can lead to unpaid invoices or bankruptcies, disrupting the supply chain.

Mitigation Strategies

- Diversification:

- Sourcing feedstocks and materials from multiple regions reduces dependency on a single supply source.

- Resilient Infrastructure:

- Upgrading facilities and transport networks to withstand extreme weather and cyber threats.

- Inventory Management:

- Maintaining strategic reserves of feedstocks and products to buffer against supply disruptions.

- Digitalization:

- Implementing AI, IoT, and blockchain to improve supply chain visibility and risk management.

- Sustainability Investments:

- Transitioning to renewable feedstocks and circular economy practices to reduce dependence on traditional supply chains.

Conclusion

Petrochemical supply chain disruptions pose significant risks due to the industry’s complexity and reliance on global trade and feedstocks. While these risks can lead to production delays, cost increases, and downstream impacts, adopting diversification, digital tools, and sustainability practices can help mitigate their effects. Proactive planning and investment in resilience are crucial for maintaining supply chain stability in the face of ongoing challenges.

Hashtags

#SupplyChainDisruptions #PetrochemicalRisks #SupplyChainChallenges #IndustrialDisruptions #SupplyChainVulnerabilities #PetrochemicalIndustryFocus #PetrochemicalSupplyChain #ChemicalLogistics #PetrochemicalChallenges #SupplyChainInChemicals #EnergySupplyChain #CausesofDisruptions #GeopoliticalRisks #EnergyMarketFluctuations #NaturalDisastersImpact #TradeDisruptions #RawMaterialShortages #MitigationStrategies #ResilientSupplyChains #SupplyChainManagement #RiskMitigation