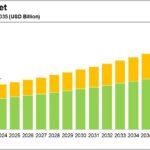

India’s petrochemical industry is poised for significant growth, with demand projected to increase by 8% in 2024. This surge is driven by the expanding middle class and heightened consumption across various sectors. The Indian Chemicals and Petrochemicals sector is anticipated to grow from its current market size of USD 220 billion to approximately USD 300 billion by 2025.

However, this robust demand is tempered by challenges arising from market oversupply. The global petrochemical industry is contending with overcapacity, particularly in regions like China and the Middle East, leading to increased competition and pressure on profit margins. In 2023, India’s imports of polyolefins, a major segment of its petrochemical imports, surged, notably from China. Polypropylene imports increased by 39% year on year to 1.02 million metric tons between January and September, while polyethylene imports rose by 108% to 2.34 million metric tons.

To address these challenges and capitalize on growth opportunities, the Indian government is actively promoting the petrochemical sector. Oil Minister Hardeep Singh Puri announced plans to attract $87 billion in investments over the next decade, aiming to bolster domestic production and reduce import dependency.

In summary, while India’s petrochemical industry is set for substantial growth in 2024, it must navigate the complexities of market oversupply and global competition. Strategic investments and policy initiatives are essential to enhance domestic production capabilities and maintain profitability in this evolving landscape.