Energy prices profoundly impact the production of basic chemicals, as the industry is highly energy-intensive. Changes in energy costs directly affect production costs, profitability, and competitiveness. Here’s a detailed analysis of how energy prices influence essential chemical production:

1. Cost of Raw Materials

- Feedstock Dependency:

- Basic chemicals like ammonia, ethylene, and methanol rely on hydrocarbons such as natural gas and crude oil as feedstocks.

- Impact:

- Rising energy prices increase the cost of these feedstocks, driving up production costs for chemical manufacturers.

- Example: Higher natural gas prices significantly raise the cost of ammonia production via the Haber-Bosch process.

2. Operating Costs

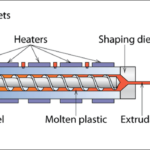

- Energy-Intensive Processes:

- Processes like cracking, distillation, and electrolysis require large amounts of energy.

- Impact:

- Increased electricity or fuel costs raise operational expenses, reducing profit margins.

- Example: Steam cracking for ethylene production is particularly energy-intensive and sensitive to energy price fluctuations.

3. Global Competitiveness

- Regional Disparities:

- Regions with access to cheaper energy sources, such as the Middle East or the U.S. (due to shale gas), have a competitive advantage in chemical production.

- Impact:

- Rising energy prices in certain regions can shift production to areas with lower energy costs, impacting global trade patterns.

4. Product Pricing and Supply Chain

- Pass-Through Costs:

- Higher energy prices often lead to increased prices for basic chemicals, which are passed down the supply chain.

- Impact:

- Increases the cost of downstream products, such as plastics, fertilizers, and consumer goods.

- Can lead to reduced demand for higher-priced products, affecting overall market dynamics.

5. Investment in Energy Efficiency

- Technological Upgrades:

- High energy prices incentivize investments in energy-efficient technologies and processes.

- Impact:

- It improves long-term cost-efficiency and reduces the industry’s reliance on volatile energy markets.

- Example: Using heat integration and advanced catalysts to lower energy consumption in chemical reactions.

6. Transition to Alternative Energy Sources

- Renewable Energy Integration:

- Rising fossil fuel prices accelerate the adoption of renewable energy for powering chemical plants.

- Impact:

- Shifts industry focus towards sustainable production methods, such as green hydrogen and bio-based feedstocks.

- Reduces exposure to fossil fuel price volatility in the long term.

7. Impact on Profit Margins

- Squeezed Margins:

- Energy cost spikes reduce profitability, especially for producers unable to pass costs onto customers due to market competition or demand constraints.

- Impact:

- Smaller or less efficient producers may struggle to remain viable during periods of high energy prices.

8. Impact on Greenhouse Gas Emissions

- Shift in Production Practices:

- High energy prices may prompt shifts to low-carbon alternatives, such as electrification of processes or utilization of renewable feedstocks.

- Impact:

- Reduces carbon emissions and aligns the industry with sustainability goals.

9. Supply Chain Disruptions

- Ripple Effects:

- Energy price increases can disrupt supply chains, as transportation and raw material extraction also become more expensive.

- Impact:

- Delays and cost overruns in chemical production, leading to potential shortages of essential chemicals in the market.

10. Long-Term Strategic Changes

- Diversification of Energy Sources:

- Chemical manufacturers are increasingly diversifying their energy mix to include renewables, nuclear power, and energy storage systems.

- Impact:

- Reduces dependency on fossil fuels and mitigates the risks associated with volatile energy markets.

- Example:

- Companies investing in green hydrogen production to replace natural gas in ammonia synthesis.

Case Study: Natural Gas Prices and Ammonia Production

- Natural gas prices surged globally in 2022–2023 due to geopolitical tensions and supply chain disruptions.

- Impact:

- Ammonia production costs rose sharply, leading to higher prices for fertilizers like urea.

- Some manufacturers reduced production or shut down operations temporarily, creating supply shortages and market instability.

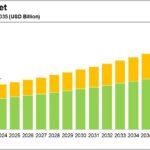

Future Outlook

- Energy Transition:

- The chemical industry is increasingly focusing on reducing its reliance on fossil fuels by adopting renewable energy and energy-efficient technologies.

- Market Volatility:

- Continued geopolitical and economic uncertainties may result in fluctuating energy prices, necessitating robust risk management strategies.

- Sustainability Goals:

- Regulatory pressures and corporate commitments to sustainability will drive investments in alternative energy sources, minimizing the long-term impact of energy price volatility.

Conclusion

Energy prices are a critical factor in the economics of essential chemical production. While rising prices can strain profitability and disrupt markets, they also present opportunities to innovate and transition towards more sustainable and efficient practices. Proactive investments in energy-efficient technologies and diversification of energy sources are essential for building resilience and maintaining competitiveness in the face of energy market volatility.

Hashtags

#EnergyAndChemicals #ChemicalProductionCosts #EnergyImpact #IndustrialEnergyDemand #EnergyEconomics #EnergyPriceDynamics #EnergyPriceTrends #RisingEnergyCosts #EnergyMarketImpact #GlobalEnergyPrices #EnergyCostChallenges #ChemicalSupplyChain #IndustrialEnergyCosts #ChemicalIndustryTrends #EnergyDrivenEconomy #EnergyDependency #EnergyEfficiency #SustainableChemicals #GreenEnergyForChemicals #EnergyOptimizedProcesses #LowCarbonChemistry